When employees come to you with questions about exercising their stock options, you want to help them make the right decision.

The problem?

These kinds of questions are common—meaning they take time away from your finance, HR, and legal teams. And to answer them well, you need to know personal information like how much cash someone has on hand, the importance they place on tax efficiency, their risk tolerance, and their belief in the company’s trajectory—which you aren’t privy to.

You also could open your company up to liability, if someone decides to sue for what they later may deem to have been bad advice. For any personal tax questions, you should direct your employees to talk to a tax advisor. But if you receive questions during All-Hands or over Slack, you might want to work with counsel to agree on some useful general information you can share. Here’s how you might approach three of the most common questions employees have about stock options.

“Should I exercise my stock options?”

Depending on your past startup experience, or personal belief in the company, it can be tempting to give a “yes” or “no” answer to this question. Stick to the objective information they need to make this decision.

Approach

Remind your employees that choosing whether or not to exercise is an investment decision and there’s no guarantee that it will result in a profit.

Show them where they can find their grant information which includes the strike price, vesting schedule, and other data that will help them make an informed decision.

Provide objective information like the company’s current fair market value (FMV) and send them educational materials about stock option basics and what it means to exercise stock options.

Avoid

You or your company could increase the risk of employee disputes or liability if you:

Give advice on whether to exercise or not

Avoid giving any form of advice, which includes telling employees to exercise their stock options or not. You want your employees to make their own decisions and not feel influenced in their decision making.

Predict the future value of the stock or promise a payout

While you may whole-heartedly believe in the future of your company and want to get employees excited about it, there’s a fine line between creating enthusiasm and creating liability. Avoid promising that your company will IPO or telling them what their stock will (or should) be worth in the future.

“When’s the best time to exercise my stock options?”

Sometimes, employers tell employees to exercise as soon as possible to save on taxes. Other times, they tell their employees to not worry about their stock options until a liquidity event. You shouldn’t be telling your employees when to exercise their options at all.

Approach

Let your employees know that there’s no one-size-fits-all answer to finding the best time to exercise. It depends on a lot of personal factors—like whether they have major purchases coming up that would compete with the cost of exercising. They should consult with their own legal, tax, and financial advisors before making a decision.

Educational materials about how stock options are taxed can point to common times startup employees decide to exercise and help them start thinking through the tax implications of exercising.

Avoid

There are lots of things you might say that could open you or your company up to unnecessary risk; it’s always best to talk to your counsel. Here are a couple of things to avoid:

Making statements that convey urgency to exercise

Avoid saying that your employees should exercise soon to take advantage of tax savings, or that they should wait until you IPO.

Predicting the future value of the stock or the potential payout

While you can share a chart showing what the value of their equity could be if you reach a certain valuation, you want to make it very clear that you can’t promise you’ll reach that valuation.

“How much will I owe if I exercise my stock options?”

Here’s a question you can answer more directly—in part.

Approach

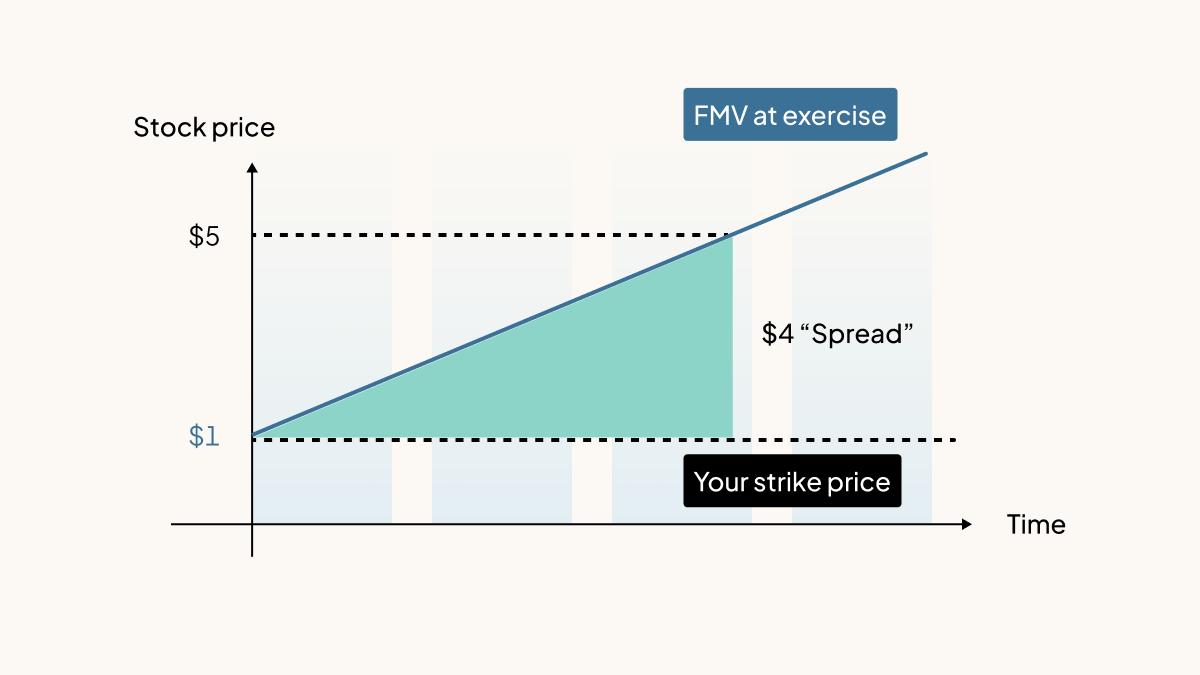

Let your employees know that when they exercise their options, they’ll need to pay the strike price (also known as “exercise price”) for each share they buy—and that they could also owe taxes on the “spread.” The spread is equal to the difference between their strike price and the FMV of your company’s stock on the day they exercise.

Avoid

You may get employee complaints if you:

Promise the exact amount of taxes they’ll owe

You can provide estimated taxes, but the exact amount an employee owes when they exercise or sell will depend on the type of equity they hold and their unique tax situation. Tax calculations are based on factors like their overall income (which may include income beyond their salary), marital status, residency, and home ownership.

How Carta Equity Advisory can help

Give your employees comprehensive equity education and a deeper level of support around potential risks and tax considerations for exercising and selling their equity — with almost no lift on your part.

Equity Advisory is a subscription service Carta offers to cap table customers. It includes company-wide webinars and 1:1 sessions with our accredited Equity Tax Advisors, who can field all your employees’ equity and tax questions—freeing up time for your finance, HR, and legal teams. Equity Advisory can:

-

Help employees develop tax strategies that meet their financial goals

-

Review tax implications of exercising or selling based on their unique tax situation

-

Provide scenario modeling to help employees make informed decisions

-

Walk employees through how company events like liquidity events or 409A valuations impact taxes

If you’re interested in learning more, book a demo today.